PROPOSALS: EXEMPTING SMALL TRANSACTIONS BETWEEN PRIVATE INDIVIDUALS, ENSURING FAIR TAXATION OF PROFESSIONALS

Before the mass development of the online platform economy, the question of taxation of low additional income of individuals was not really posed, because of an implicit tolerance which relied on the inherent limitations of the means of control and the small amounts at stake. In short, the tax and social contribution rules were certainly complexbut they were simply not enforced, or very little, and on a case by case basis .

Although trading between private individuals has today become massive, recurrent and standardised via the use of a few platforms, and furthermore traceable in real time and often to the nearest euro, the long-avoided questions are inevitably being asked, and the answers given by existing law are inadequate.

It is all the more urgent to give the collaborative economy a suitable framework since the platforms, just a few months from now, will have to report the income of their users to the URSSAF (Social Security Contributions collector) and to the tax authorities.

The Working Group of the Finance Committee of the Senate, on tax and tax collection in the digital economy therefore proposes a general reform, based on a requirement of simplicity for users, consistency between the tax and social contribution rules, and fairness between taxpayers.

This reform meets a twofold need:

- on the one hand, giving adequate space for trading between private individuals, by laying down a single threshold of EUR 3,000 allowing, as regards taxation, the exemption of low occasional and sideline income and as regards social contributions, drawing the border between private individuals and professionals;

- on the other hand, guaranteeing equality before taxation and the conditions for fair competition between professionals , by ensuring the reporting and fair taxation of significant income, without a distortion of competition or loss of tax and social contribution income.

By linking the benefit of the EUR 3,000 threshold to the acceptance of automatic income reporting, the Working Group is counting on a virtuous circle .

Finally, it is important to emphasise that the Working Group has, in its proposals, taken scrupulously care to comply with the three following rules:

- no new tax . On the contrary, the Working Group proposes a tax advantage, targeted at low additional occasional income, which currently, in principle, is taxed from the first euro;

- no changes to the balances between the tax and social contribution systems . The proposals relate exclusively to low additional occasional income. They do not in any way call into question the boundaries and parameters which exist between the social protection systems, and in particular between the micro-enterprise system and the ordinary law self-employed workerssystem . Neither do they modify the various existing tax systems (for example, for rental income: short duration furnished rentals, professional furnished rentals, guest rooms, real estate income, etc.), but are limited to delaying the time when the question arises. Above the EUR 3,000 threshold, these apply automatically and to all income, without exception;

- n o sector-specific new rules and obligations . The Working Group proposes a tax and social contribution system applicable to the entire online platform economy, without distinction between income and activities, convinced that only a general and general approach could provide the much-needed security of the actors concerned users, platforms, but also the traditionalprofessions. Possible changes to sector-specific rules, for example as regards transport, accommodation, catering or crafts, goes beyond the remit of this report and in any event do not fall within the competence of the Working Group of the Finance Committee. This is also the case, for the rules applicable as regards labour law, consumption, competition, etc.

On all of these issues, the Working Group, relying on its pluralist composition and its collegial way of working, has taken care not to pre-empt the national debate or the necessary consultations .

All the members of the Working Group remain convinced that with clear, unified and fair rules, whose compliance is ensured, there is no reason to pit the digitaleconomy against the traditionaleconomy.

I. A SINGLE THRESHOLD OF EUR 3,000 PER YEAR TO EXEMPT LOW, OCCASIONAL AND SIDELINE INCOME OF INDIVIDUALS

A. THE CHOICE OF A FIXED TAX ALLOWANCE

Currently, all income derived from online platforms must be reported from the first euro and is subject to income tax, if some rare exceptions are excluded. These rules are often not complied with and, if they were, they would not really allow the sharing economyto develop.

In order to clarify things and give a legal basis to the non-taxation of low additional occasional and sideline income of private individuals, it is proposed to establish a fixed tax-free allowance of EUR 3,000 on all income received via online platforms .

More specifically, the proposed mechanism would mean that the proportional tax-free allowances provided for by the micro-tax system cannot, cumulatively, be less than EUR 3,000 for income received through online platforms. For information, the proportional micro-tax tax-free allowances, which replace “real” charges, are 71% of gross income on sales of goods under the micro-BIC system, 50% for services under the micro-BIC system (which include passenger transport and the rental of furnished accommodation), 34% for services under the micro-BNC system, and 30% for non-furnished rentals under the micro-real estate system. The net taxable income would therefore still be established by application to the gross income of the most advantageous solution for the taxpayer , i.e. either the fixed tax-free allowance, or the proportional tax-free allowance.

Symmetrically, for taxpayers opting for the actual income and charges regime , it would be expected that the fees and charges deducted from the gross income derived from the platforms may not, in any case, be less than EUR 3,000.

|

Proposal No. 1 Establish a fixed tax allowance of EUR 3,000 on all income received by individuals via online platforms and automatically reported by these platforms, so that occasional and sideline income can be exempted with a simple rule. For amounts above EUR 3,000 of gross income, the tax advantage would be regressive, and would become neutral when the income becomes significant. |

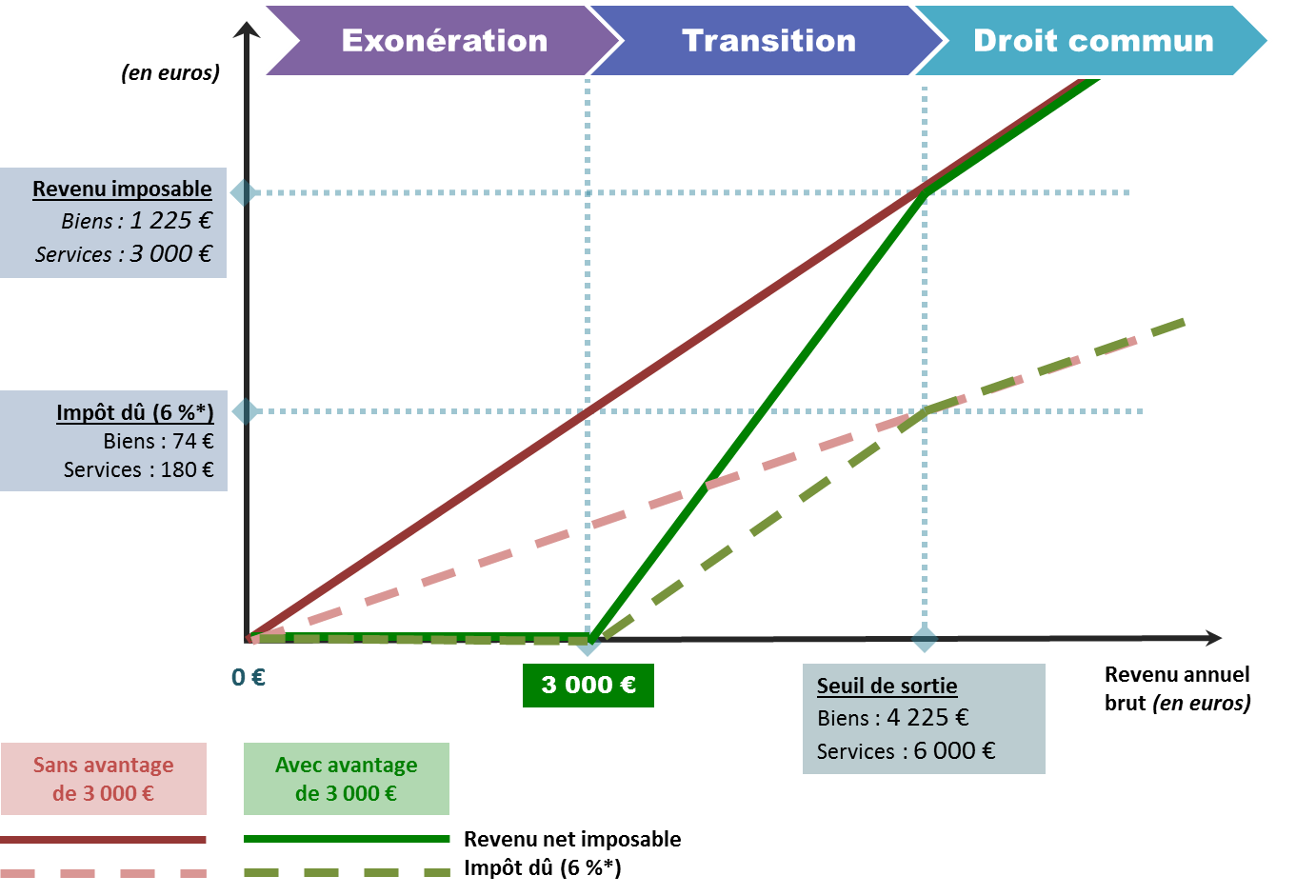

The main advantage of an alternative tax-free allowance to the proportional tax-free allowances is that this option allows for a gradual exitfrom the mechanism, and neutrality beyond a certain amount of income. As shown in the diagram below, three situations are thus distinguished:

Exemption : if the gross income is between EUR 0 and EUR 3,000, it is totally exempt from income tax , since the fixed tax-free allowance of EUR 3,000 is greater than the gross income. A student offering a few hours of babysitting services per week or a young couple which rents out its unused pram would thus be exempt without any procedure to fulfil or evidence to present;

Transition : if the gross income is greater than EUR 3,000, the taxpayer continues to benefit from a tax reduction for as long as the fixed tax-free allowance remains more favourable than the proportional tax-free allowance. The exit threshold from the mechanism is reached when the proportional tax-free allowance is equal to EUR 3,000, i.e. an exit thresholdof EUR 4,225 for sales of goods, EUR 6,000 for services under the BIC system , EUR 8,824 for services under the BNC system and EUR 10,000 for real estate income 58 ( * ) (see below);

Ordinary law : when the gross income is greater than the exit thresholds of the mechanism, the effect of the measure is neutral , since the ordinary law tax-free allowances are greater than the proposed fixed tax-free allowance, and therefore more advantageous for the taxpayer.

|

The effect of the fixed tax allowance of EUR

3,000

(An example of sales of goods and BIC services) Where the micro-tax system is applied, the net taxable income would be calculated by applying a proportional tax-free allowance of 71% (sales of goods) or 50% (services BIC) to the gross income. This allowance is currently set at a minimum amount of EUR 305 (not shown here). The proposed tax advantage consists of raising the minimum amount of the tax-free allowance to EUR 3,000 for income reported by the platforms. For as long as the gross income is less than the EUR 3,000 tax-free allowance, the taxpayer is exempt. The exemption threshold (EUR 3,000) is the level where the EUR 3,000 tax-free allowance is equal to the gross annual income. For as long as the amount of EUR 3,000 is more favourable than the proportional tax-free allowance, the taxpayer will benefit from a tax reduction. The exit threshold is the level of annual gross income starting at which the proportional tax-free allowance of the micro-tax system becomes more favourable than the fixed tax-free allowance of EUR 3,000. The above exit thresholdsare valid if the gross income received through platforms relates entirely to only one of the categories. In the case of mixed income, the actual exit threshold depends on the share of each category of income. * By convention, income is taxed at the rate of 6%, equivalent to the average rate of taxation of all payers of income tax (approximately 46% of all tax households). The actual tax rate depends on all the income and the composition of the tax household. Source: Senate Finance Committee |

* 58 These thresholds are valid if the gross income received via platforms relates entirely to only one of the categories. In the case of mixed income, the actual exit threshold depends on the share of each category of income.

The fact that the exit threshold is higher for services (under the micro-BIC system and necessarily under the micro-BNC system) than for sales of material goods is explained simply by the fact that the proportional tax-free allowance applicable to sales of goods (71%) is significantly higher than that applicable to services (50% or 34%) or to the micro-real estate system (30%).