B. DETAILS ABOUT THE AUTOMATIC REPORTING PROCEDURE

1. The user's prior explicit agreement

The user would, on registering on a platform, give his agreement to the automatic reporting of his income, by ticking a simple checkbox:

|

I agree to my income being reported by [ THE PLATFORM ] to the tax authorities. I benefit in return from a tax advantage, in the form of a fixed allowance of EUR 3,000 on my gross income. My income will not be taxed if it does not exceed €3,000 per year on online platforms, or if I am not liable to pay income tax, or if it is income that is exempt by its nature (second-hand sales, cost-sharing). |

On this occasion, he would provide the identification number that the tax authorities can use to identify him . This number could either be the tax number, or a specific number (see below).

The gross income would be reported by the platforms to the General Directorate of Public Finance (DGFiP), in January of each year, in a standardised format, laid down in a decree . The tax authorities would then total the income of the same taxpayer derived from several platforms, to arrive at a gross overall annual income received via online platforms , and check whether the EUR 3,000 has been crossed.

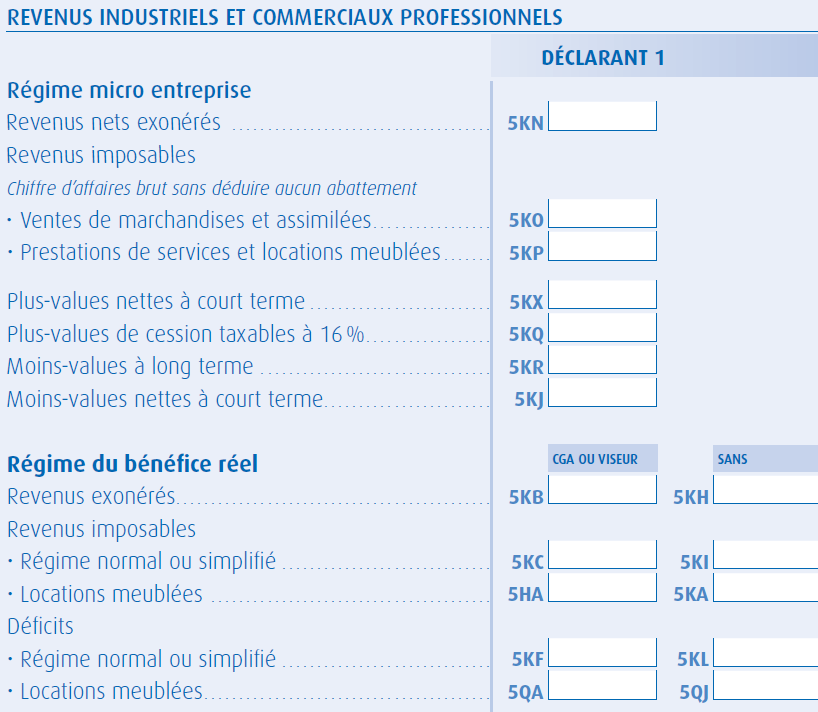

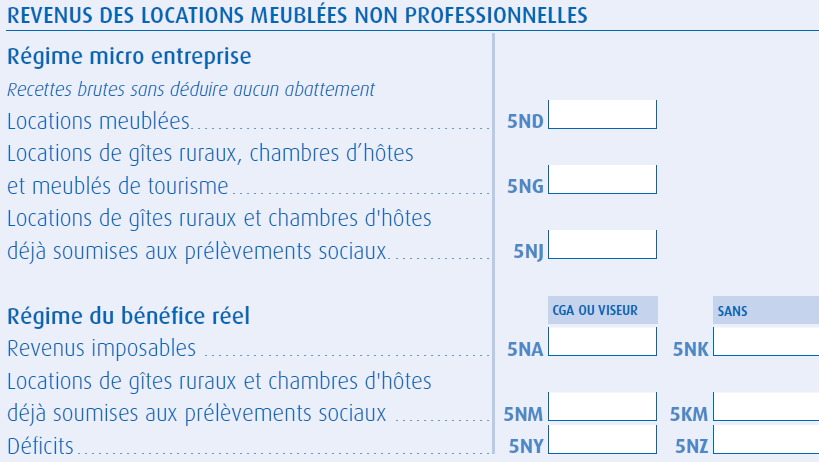

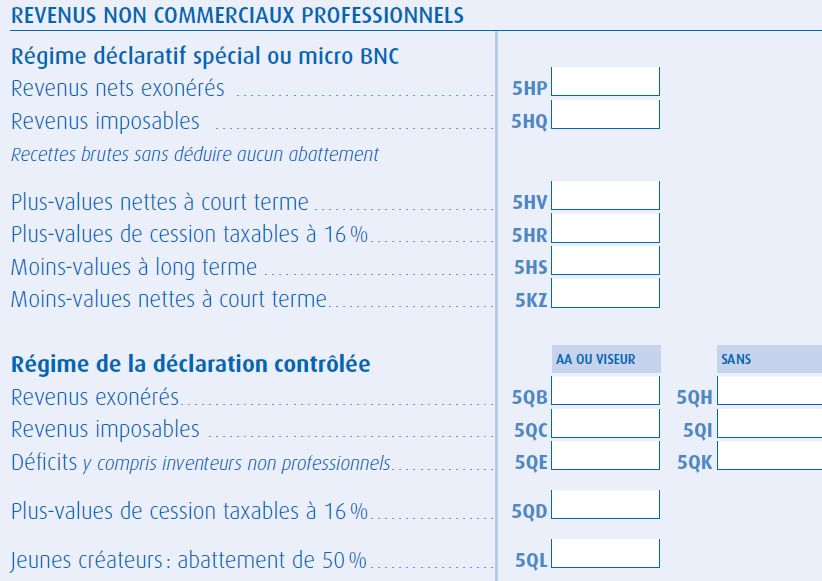

The taxpayer would then find these amounts in his usual pre-filled tax return (No. 2042 C), indicated in the corresponding category (BIC, BNC, micro/actual income, etc.). The only difference compared to the example below is that a checkbox gross income received and reported via online platforms would be added, to emphasise that this gives an entitlement to the fixed allowance of EUR 3,000.

|

Tax Return Form No. 2042 C

Pro

|

|

|

Source: General directorate of public finances |

|

As explained above, any reported income is not necessarily a taxed income . In particular, taxpayers not liable to income tax (whose annual net income, including income derived from platforms and after application of the tax-free allowance, does not exceed EUR 9,710 per share of family quotient), will of course not be taxed.

The fact that the income is pre-filled in the tax return does not prevent the taxpayer from making, where appropriate, corrections or changes when validating this return on impots.gouv.fr , under conditions of ordinary law. In particular, this may arise if the taxpayer opts for the real charged benefits income system (he must in this case report his charge), or if he considers that certain income relates to another category or if he benefits from an exemption in some way.

2. Content of the report: only available, relevant and strictly necessary information

In accordance with the requirements of proportionality and respect for privacy, and in order not to unnecessarily complicate the operational implementation of the system, the Working Groups proposal provides that the platforms will transmit all the necessary data, but only the necessary data , i.e. the four following items of information:

1° The full name, email address and identification number of the user ” , so that the authorities can identify and total all of his income received via platforms without any mistakes, omissions or duplicates;

2° The total amount of the gross income received or assumed to have been received by the user during the previous calendar year on the basis of his activities on the online platform, or paid through it : this broad formulation means that both platforms which act as payment intermediaries and those which, while not involved in the transaction itself, are aware of the amount since they have put the seller and buyer in contact with each other are covered. It should be noted that the transmission refers to gross income : in no case is the platform asked to calculate net income or determine whether the income or the user is taxable. This is not, and is not intended to be, the responsibility of the online platform operators ;

3° The number of transactions through which this gross income has been received : this information is also provided for in Article 242 bis of the General Tax Code and makes the reporting more reliable;

4 The category to which the gross income is assumed to relate : for each reported income stream, the platform must specify to which of the following categories they relate: sales of goods; services; rentals of movable property; rentals of immovable property . They allow the tax authorities to enter the income in the corresponding box of the pre-filled tax return: BIC, BNC, real estate income, etc. These categories are by definition known about by the platform , since they correspond to the activities offered. No additional reporting is therefore requested from the user.

With the exception of the identification numberdescribed in 1° (see below), all this information is already known by the platforms, and must moreover be compulsorily collected under the provisions of Article 242 bis of the General Tax Code , and is indicated on the annual summary sent to the user. These data are also in line with those which are sent to the Internal Revenue Service in the United States and to the HM Revenue & Customs in the United Kingdom (see above).

Implementation of A.I.R. therefore does not involve any further collection of additional data compared to the current situation : it only involves, so to speak, sending a copy of the annual summaryto the authorities, with the user's agreement - nothing else.

By limiting the scope of automatic reporting to the necessary data only, the Working Group's proposal reassures users and facilitates the adoption of the system and its implementation by the platforms , without compromising in any way the ability of the authorities to determine, where appropriate, the right level of taxation 72 ( * ) .

3. Unique identification number or tax identification number?

In order to guarantee the reliability of the statements and as appropriate the taxation, the authorities must be able to identify precisely which taxpayer has received the income reported by the platforms , avoiding, for example, assigning to a person the income of a namesake, or a user using the same email address. It is therefore proposed that each user of the online platform is associated with a unique identification number , which would be indicated on the reporting statement.

Two solutions, fairly similar to each other, may be envisaged.

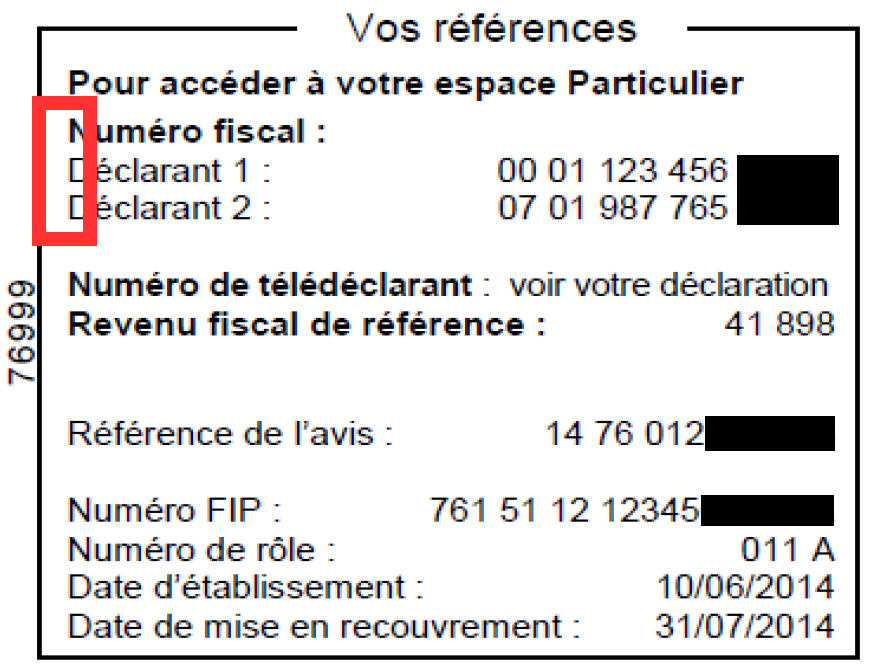

First, use the tax identification number (TIN) , assigned to each French taxpayer liable to income tax , which makes it the most reliable number. This could be requested by the platform, when the user gives his agreement to automatic reporting.

|

Source: European Commission, DGFiP |

The TIN is indicated on the pre-filled tax return for income tax and the income tax, housing tax and land tax notices. Those liable to income tax must enter it on the impots.gouv.fr website to carry out their procedures. |

In addition to its reliability, the TIN has another great advantage: it has undergone some standardisation at the international level , by the OECD and by the European Commission 73 ( * ) , as part of the implementation of the automatic exchange of tax information (AEI) . Thus, Article 1649 AC of the General Tax Code, the legal basis of exchange of information in domestic law, obliges financial institutions to collect the tax identification numbers of all the holders of accounts and of the people controlling them .

Standardisation of the TIN ( Tax Identification Number ) is an important argument in favour of the generalisation of automatic reporting. In particular, it would mean that platforms would not to have to develop an information system for each country , and it could possibly mean that users becoming tax residents of another country would not to have to change number. The fact that the definition of the TIN is the same for the automatic exchange of information (AEI) with the United States , governed by a specific text 74 ( * ) is an additional argument, since most of the main international platforms are American.

The main limitation of the TINsolution is connected to its possible consequences on the user experience or, to put it simply, to the fear expressed by some platforms that this option will create mistrust, if not reluctance, among users, leading them to turn to other platforms. That said, this potential obstacle must not be overestimated , given the sometimes more sensitive information that the platforms already request from their users (see below).

The second solution consists of assigning each user a specific number as a user of collaborative platforms . Thus, when first registering on a platform offering automatic reporting, he would be redirected to a single official page where he would enter, for the first and last time, his tax identification number, and would be assigned his platformsnumber. Subsequently, it would be the latter, and only the latter, that he would use for later registrations on other platforms this number could also be useful besides the reporting procedure as regards taxation. Only the tax authorities would be able to establish the link between the platformsnumberand the tax identification number.

After the initial registration stage, this solution could appear less intrusive than using the TIN , and therefore easier to adopt by the users and platforms. However, there is a risk that other countries would make a different choice, ultimately resulting in greater complexity.

In any case, one or other of these solutions should allow a high degree of reliability of the data transmitted by the platforms .

4. High level of data protection

Automatic income reporting implies, in a completely usual way, the processing of personal data. It is recalled that under the terms of Article 2 of the Data Protection Act No. 78-17 of 6 January 1978, personal data means any information relating to an identified natural person who can be identified , directly or indirectly, by reference to an identification number or to one or more elements that are particular to him .

Thus, the platforms which would ask their users for an identification number but also simply their name, email address or their telephone number would be subject to the provisions of Article 22 of the Act of 6 January 1978, under which the automated processing of personal data are subject to the National commission of data processing and freedoms (CNIL) . The CNIL, the French data protection authority system is the mainstream regime and must be distinguished from the declaration authorisation regime provided for in Articles 25, 26 and 27 of the Act, which regards more intrusive processing 75 ( * ) .

Two additional remarks can be made.

First, online platforms constantly process personal data regarding each of their users this is central to their economic model. These data are often much more intrusive: the mobility platforms require a photo of the persons driving licence, vehicle registration and insurance certificates, as well as a copy of the criminal record, rental platforms require the address of the accommodation, marketplaces and platforms of professional services require a VAT number and a corporate registration certificate, etc. They retain geolocation data, pages visited, the persons contacted etc. These data can be resold to third parties. In principle, the platforms all specify in their general terms of use (GTU) that the data collected are subject to declaration to the CNIL regarding the collection and processing of personal information relating to users . Indeed, this processing is as a minimum subject to declaration to the CNIL, or even to authorisation. The proposed mechanism is, in comparison, very modest.

Secondly, the data necessary for implementing automatic income reporting i.e. a name, a number and a gross income is extremely limited in comparison with the other third-party reporting systems provided for by French law. They are, for example, very limited compared with the data needed for single social security declaration (DSN) that all companies must fill about their employees, with the necessary data for the levy at source of income tax, with the data collected for the purpose of the automatic exchange of tax information, etc.

As a precaution, it would however be explicitly laid down in law that the operators of the online platform are permitted to collect their userstax identification numbers, and that any processing of personal data is subject to the Data Protection Act No. 78-17 of 6 January 1978 , on the model of Article 1649 AC of the General Tax Code, the legal basis of the automatic exchange of information in domestic law.

|

Article 1649 AC of the General Tax

Code

The holders of accounts, insurance companies and equivalent and any other financial institution indicate, on a statement filed under the conditions and time limits laid down by decree, the information required for application of 3 bis of Article 8 of the Directive 2011/16/ EU of the Council of 15 February 2011 on administrative cooperation in the field of taxation and repealing Directive 77/799/ EEC and the conventions concluded by France allowing for the automatic exchange of information for tax purposes. This information may, in particular, include any income from investments as well as the balances of accounts and the surrender value of bearer bonds or guaranteed investment contracts and investments of the same kind. In order to meet the obligations referred to in the first sub-paragraph, they implement, including by processing personal data, the steps required to identify accounts, payments and people. For this purpose, they collect information about the tax residences and tax identification numbers of all holders of accounts and of the persons controlling them. This possible processing is subject to the Data Protection Act No. 78-17 of 6 January 1978. |

5. Technical implementation: the requirement of simplicity

It is imperative that automatic income reporting remains very simple for users .

Given the voluntary nature of the measure proposed by the Working Group, and given the crucial importance that is attached to the user experiencein the world of the collaborative economy , where a detail in the usability of a platform can make the difference between winning or losing market shares, automatic income reporting will only be adopted and offered by the platforms provided it imposes as few formalities as possible on the user.

This also the main thing that has been learned from the success of the automatic reporting system implemented by Estonia , and more generally of this countrys success in putting its administrative procedures online (see below).

In this regard, the Central agency for social security organisations (ACOSS) , responsible for the operational implementation of automatic reporting in the social field (see above), under the control of the Social security directorate (DSS), is currently working on establishing an all inclusiveservice solution , through which all the administrative procedures could be made directly via the platform, on the model of the chèque emploi service universel (CESU). A smartphone application is also envisaged .

These initiatives must be welcomed, and receive firm support from the public authorities .

It goes without saying that the tax component must meet the same requirement of simplicity, and that it must, of course, be combined with the social contributionsportal.

Reporting to the URSSAF comes into force on 1 January 2018 and the Working Group proposes to set the entry into force of automatic reporting for taxation on the same date.

6. The particular case of income exempt by nature and the creation of an online platform ruling

The mechanism proposed by the Working Group applies in principle to all voluntary platforms. However, some platforms offer activities which are exempt by nature (car sharing, plane sharing, cost-sharing, second-hand sales, etc.), which should not be included in the automatic reporting nor included in the calculation of the tax-free allowance.

The Working Group therefore proposes that income which is exempt by nature, i.e. for the most part, second-hand sales and activities involving cost-sharing between private individuals are not included in the reporting statement sent to the tax authorities .

Such a provision would mean that the platforms exclusively offering activities exempt by nature, and holders of the certificate provided for in Article 242 bis of the General Tax Code, would not need to implement the automatic income reporting.

By contrast, platforms offering mixedactivities , for example second-hand sales and for-profit sales, or boat rentals and excursions out to sea with the owner, would in this case only transmit the taxable income, which would benefit, if applicable, from the EUR 3,000 tax advantage .

However, it does not appear appropriate to allow platforms to assess by themselves the fully non-taxable nature of income received by their users, because of the risk of abuse and deadweight effects. This voluntary provision is therefore accompanied by more stringent conditions:

- firstly, they should have duly certified rules and procedures pursuant to Article 242 bis , and indicated in the certificate, with the purpose of ensuring that all or part of the gross income received by their users is tax-exempt income due to its nature: in other terms, it would be the third-party certifiers responsibility to assess the validity of the platforms internal criteria for separating taxable from non-taxable income;

- secondly, they should, for the purpose of transmitting the data, have these same criteria validated by the tax authorities, using a flexible approval procedure.

In practice, this new procedure could take the form of a specific tax ruling, tailored to the online platform economy , consisting for them of validating in advance not their own tax options, but the rules that they implement to determine, as far as possible, the taxation applicable to the income paid to their users.

|

Proposal No. 8 Allow online platforms to request from the tax administration, on a voluntary basis, an advance validation of their internal rules and procedures aimed at determining whether their users' income is taxable or not (online platform ruling |

This new online platform rulingprocedure could also be applied to all platforms for various subjects linked to their key role as intermediary , and not only to the platforms concerned by the above provision (mixedplatforms taking part in automatic reporting).

It would possibly require the tax authorities to develop technical expertise , or even IT expertise of the same level as that of the certifying third parties.

* 72 For a tax case that is complex to process requiring additional information, the tax authorities always have, where appropriate, the nominative communication right. It is unlikely that a certified platform offering its users automatic reporting of their income will refuse, moreover, to respond to the communication right.

* 73 The European Commission has moreover published an explanatory document describing, for each country, the structure and the specificities of national TINs, the documents on which they are indicated (tax notices, passport, driving licence, etc.), as well as the web sites and national contact points:

https://ec.europa.eu/taxation_customs/business/tax-cooperation-control/administrative-cooperation/

tax-identification-numbers-tin_en

* 74 The FATCAAct (Foreign Account Tax Compliance Act), or law relating to compliance with tax obligations regarding foreign accounts, was adopted by the United States on 18 March 2010.

* 75 For example on biometric and judicial data of interest to state security, etc.

It goes without saying, of course, that the information transmitted is in no case sensitive data within the meaning of Article 8 of the Act , i.e. personal data which reveal, directly or indirectly, a persons racial or ethnic origins, political opinions, philosophical or religious beliefs or trade union membership, or which are related to his health or sexual life .